Asian investors enthusiastic about the private equity opportunity

Asia heralded as the new fundraising region for US and European Private Equity firms.

Nearly a third of private equity firms or general partners in the US and Europe said their future fundraising efforts would likely take them for the first time to Asia-Pacific and the Middle East. 85 percent of private equity investors in Asia said their allocations to the asset class would increase or remain stable in the coming years, reveals new research released on Monday by BNY Mellon and Private Equity International (PEI).

The paper, entitled “Private Equity Faces the Future: Candid Views from the Market,” explores the changing relationships between limited partners (LPs) and general partners (GPs) and how this evolving dynamic will impact the market. While economic events of 2008-2009 tested assumptions about private equity performance as well as long-standing relations between LPs and GPs, the research shows that private equity continues to grow as an attractive asset class to Asian investors.

GPs are seeing many Asian LPs as having a strong appetite for the asset class, many of them managing relatively young programs with significant target allocations to put to work. Some GPs have sought out new types of LPs e.g. SWFs and large corporations looking to gain access to new technologies through venture funds – an expansion on the traditional research and development strategy.

In Asia (including Australia) 71 percent of respondents said their allocations to private equity would be unchanged and 14 percent said they would increase their allocations. This result was similar to Europe (66 percent and 11 percent) but different to the US where 44 percent said they would increase their allocations. In Asia this perhaps reflects the feedback that whilst those Asian LPs without significant legacy portfolios are particularly enthusiastic about the PE opportunity going forward, they described their boards as needing further education and experience to become more comfortable with PE as an asset class.

The likelihood that a board might view PE more negatively immediately following the economic downturn was correlated to the tenure of the asset class in the given geography. Board members at 40 percent of Asian LP respondents were described as having recently adopted a more negative view of PE compared with 25 percent in Europe and just 14 percent in North America. As GPs increasingly seek to geographically diversify their LP base, it will be critical for boards outside of North America to even further embrace PE.

"While LPs in Asia are enthusiastic about private equity, they recognise that there remains a gap in education and experience. LPs in Asia, along with those in the rest of the world, will be looking at aligning their interests with GPs, as well as improved transparency and reporting," said Andrew Gordon, head of BNY Mellon’s Alternative Investment Services group in Asia. "In turn, GPs need to adapt by building a sophisticated infrastructure to service investors throughout the economic cycle."

"Investors today are seeking much clearer evidence that private equity fund managers can create fundamental value in the companies they acquire and can deliver consistent returns in good or bad times," said Tim Jenkinson, professor of finance at Oxford University's Saïd Business School and director of the Oxford Private Equity Institute. "For GPs this means launching the next fund will pose a tougher challenge, but for those who can adapt and survive, the result is likely a stronger private equity sector overall."

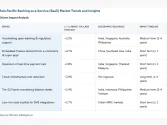

Key findings from the paper include:

Optimism remains intact

• 79 percent of LPs say their private equity allocations will hold steady or rise in the years ahead, but average commitment sizes have declined

• Asian GPs are the most bullish about the future of the private equity industry with a score of 4.29 (five being most bullish and one being least bullish), followed by North America (3.83) and Europe (3.62), Asia perhaps reflecting an important geography that sees itself on the cusp of major growth

• Asian LPs, many of them newer to the asset class, are enthusiastic about upcoming PE opportunities but often constrained by cautious board overseers. In turn, many North American and European GPs suggest they will head to Asia for the first time to raise funds.

Focus on realignment of interests

• LPs and GPs alike expect that management fees and transaction fees will be of highest priority in upcoming partnership term negotiations

• GPs are receiving more extensive requests for information about portfolio companies and the firms themselves. Most expect a fundamental change in the detail and frequency of investor reporting.

Assessing regulatory proposals

• Asian market participants tend to be most concerned about broader tax and regulation issues, particularly those that may emanate from China.

• The concern amongst GPs on the general corporate tax level was voiced frequently by Asian market participants particularly those in Japan. They pointed to the high tax rate for Japanese corporations as an impediment to attracting foreign investors.

• From a regulatory perspective, often the concerns of Asian GPs were tied to doing business in China where they perceived that the regulatory regime was less clear and less stable. This may negatively impact the development and growth of similar budding PE markets.

• Among many regulatory and tax proposals, GPs globally were very concerned about the potentially expensive and restrictive requirements of the proposed European Union Alternative Investment Fund Manager (AIFM) directive

The BNY Mellon/PEI white paper was based on 102 detailed interviews conducted between December 2009 and March 2010 with GPs, LPs and other industry stakeholders. Participants ranged from small niche firms to some of the largest global investing institutions. Half of the respondents were based in North America, 29 percent in Europe, and 21 percent in Asia-Pacific. The total private equity capital commitments managed by responding GPs and LPs exceeded US$425 billion.