Asia Pacific private equity fund pool tops $218 billion

The Asian Venture Capital Journal (AVCJ) has announced its full-year research figures for 2008. The Asian Private Equity and Venture Capital Report shows that Asian private equity enjoyed strong growth throughout the last year, with total capital management for the region breaking through the US$200 billion level for the first time to reach just over US$218 billion, and growing at an annualised rate of 14.4 percent. Trade sale exits also showed a 2.2-percent rise to US$35.3 billion in 2008, sign of a healthy turnover in the industry. However, most other areas of activity, including fundraising, investments, and IPO exits, fell from their 2007 peaks during 2008—sharply in some cases.

New industry size shows maturity

Asia Pacific private equity’s eventual growth to over US$200 billion in total capital was, to some extent, inevitable and expected—what was surprising was the sustained very strong growth in a year of weaker fundraising as well as broader macro difficulties. Partly this was due to local asset managers or bankers following global trends and taking private equity offerings to local investors. Most significant of all in the strength of the growth, however, was Asia Pacific private equity’s new maturity and stability, exhibiting relative strengths as the industry in the US and Europe struggled with declining deal volumes and the collapse of leverage supply.

China and India—the principal venues for capital accumulation in 2007—once again took the lead, with China showing an 85-percent increase in its fund pool to just over US$38 billion, while India showed almost 62-percent growth to nearly US$26 billion. PRC government backing for RMB-denominated local funds was also a significant factor.

The solid growth in capital under management was not reflected in private equity fundraising over the period, though. New funds raised during 2008 fell to US$42.7 billion, down just over 23 percent from a high of US$55.5 billion in 2007. However, the decline was more a return to norms before the bumper year of 2007, and left fundraising at a level broadly comparable with 2006—a retrenchment rather than a collapse.

Most of the fundraising was focused on China and India. The PRC saw a modest 7.3-percent increase to just over US$13.2 billion, while India experienced an almost 25-percent rise in new funds raised to just under US$8 billion. More significant, perhaps, were the fundraising declines in some other markets: 67.4 percent down in Australia, 44.4 percent down in Japan, 85.7 percent down in Singapore, and no fundraising recorded at all in Korea. TPG Asia V was the foremost multi-billion fund raised during the year, at US$4.25 billion, followed by China’s Hopu USD Master Fund I at US$2.5 billion: no other fund for the region closed significantly above US$1.5 billion during the year.

Investments down considerably

New private equity investments across Asia Pacific fell some 38.4 percent to just under US$55 billion in 2008. India, one of the hottest destinations for new capital, interestingly showed a significant decline in deals during 2008, down 38.1 percent to just over US$10.7 billion of transactions. China, meanwhile, stayed in positive territory, rising 8.2 percent to just under US$13.4 billion. Elsewhere, the percentage declines in Australia, Japan, and Singapore closely followed the falloffs in fundraising, although Korea at least managed to deliver almost US$3.6 billion of transactions, slipping only 15.5 percent.

Japan did at least play host to the year’s biggest deal—the US$2.69 billion syndicate acquisition of Ashikaga Bank. Only the 90-percent acquisition of China’s Honiton Energy Holdings by Bahrain’s Arcapita and India’s Tanti Group reached the US$2 billion mark, and the largest traditional private equity buyout was CVC Asia Pacific’s 65-percent takeover of Australia’s Stella Hospitality Group, for a mere US$975 million.

Exits problematic – trade sales up, IPOs collapse

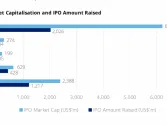

IPO exits from private equity investments slumped across Asia Pacific during 2008, falling 76.9 percent to just US$15.2 billion in 2008, down from US$65.8 billion in 2007. With most Asian bourses at record lows, private equity and venture capital firms could be forgiven for not wanting to take their investees to market in a sharply worse climate.

Trade sales, though, showed an unexpectedly better picture, with a small but marked increase of 2.2 percent from US$34.6 billion in 2007 to US$35.3 billion in 2008. Much of this, admittedly, was due to strategically-motivated deals by just one major investor—Singapore’s Temasek Holdings—which did three domestic power-related sales for a total of over US$8.3 billion and a 291-percent jump in Singapore’s private equity-related M&A volume. However, the US$6.253-billion sale of Sanyo Electric to Panasonic by a financial consortium including Daiwa, SMBC, and Goldman Sachs indicated that large deals could still be struck for the right asset in the right situation.

Most of the top ten IPOs during 2008 were China deals, even though the country saw an 80.8-percent decline in the value of listings from 2007’s US$57.5 billion to 2008’s US$11 billion, as the supply of big government-connected bank listings dried up. India also fell by some 68.6 percent in IPO value. M&A exits, meanwhile, did show some other positive trends. India registered a 63.3-percent increase in trade sales to just over US$3.1 billion, chiefly reflecting CVC International’s almost US$2.4 billion sale of Centurion Bank of Punjab to HDFC Bank. Japan’s 44.7-percent increase in M&A volume came also from Nomura’s US$1 billion sale of Tungaloy Corp. to Israel’s International Metalworking Companies and Morgan Stanley Real Estate’s US$724 million sale of the Westin Tokyo to GIC Real Estate.

Commenting on the data, Paul Mackintosh, Managing Editor at AVCJ, said, "Asia Pacific private equity has reached a new scale and level of maturity in the face of the global financial crisis, auguring well for its future stability and significance. However, there is no question that private equity firms in the region will face difficulties with recent investments, and some may not survive in their present forms to enjoy the golden harvest of bargain-basement assets that many are forecasting for 2009."

Jonathon Whiteley, Managing Director, Asia Pacific, for AVCJ parent group Incisive Media, added, "Asia Pacific private equity continues to show significant strengths and performance advantages compared to other regions worldwide. The industry does not rely on the kind of leverage levels that distinguished the US and European private equity sector, and valuations in the region have not risen to the kind of levels seen in the West. Furthermore, Asia enjoys solid macroeconomic support from China and India’s economies, adding to the healthy prognosis for the industry’s future—despite an inevitably rough 2009."