Published:

Crisis disrupts Asia's domestic bond markets

Turmoil in global credit markets is taking its toll on Asia’s emerging domestic bond markets, according to the results of the most recent Greenwich Associates Asian Fixed Income Research Study.

Asian domestic bond markets grew at a furious pace in the years leading up to the current global financial crisis. Trading volumes in the domestic currency bond markets of countries like China, Indonesia, Malaysia, India, Thailand and Australia/New Zealand increased more than 135 percent from 2006 to 2007 alone. As a result of this expansion, local currency products grew to make up over 50 percent of overall fixed-income trading volume across Asia in 2006 to 2007, up from just 30 percent the year before.

The onset of the global credit crisis stopped this growth in its tracks over the past year as local currency bond markets in many major Asian countries experienced severe retrenchment. Domestic currency fixed-income trading volume fell some 47 percent in India and contracted by about one third in China and Australia/New Zealand. These declines shrunk local-currency business to less than a third of total Asian fixed-income trading volume from 2007 to 2008.

“The development of these markets represented a profound shift for Asian financial markets,” says Greenwich Associates consultant Tim Sangston. “In the past, large Asian companies that earned most of their revenues in local currency had to obtain most of their long-term financing in dollars or European currencies—which history has proven is a dangerous position to be in. The emergence of thriving local-currency debt markets has been seen as an important new source of stability, but the severity of the current financial crisis leaves the near-term fate of these markets in real doubt.”

Surge in G-7 bonds boosts total trading volume

Despite the contraction in domestic markets—or perhaps because of it to some extent— overall Asian fixed-income trading volume (including derivatives) among investors interviewed by Greenwich Associates increased 35 percent to $2.3 trillion in 2007 to 2008. Trading volume in cash bonds was up 15 percent.

Much of that growth came about as a result of a surge of activity among institutions in Asian bonds denominated in the currencies of G-3 and G-7 countries, in which trading volumes doubled from 2007 to 2008. “This is a classic flight to quality on an historic scale,” says Tim Sangston. “Institutions are shifting en masse from local-currency bonds to Asian credit products denominated in G-3 and G-7 currencies.”

Asian institutional trading volumes in G-3 denominated Asian bonds soared 90 percent to $214 billion in 2007 to 2008. Fueling that growth was a dramatic spike in activity in G-3 denominated investment-grade sovereign/corporate issues, in which trading volume increased nearly four-fold, and in G-3 high-yield bonds, in which trading volumes more than tripled.

Overall trading volume in investment-grade credit products issued by companies in G-7 countries increased to $163 billion amongst Asian institutions in 2007 to 2008, up 55 percent from the prior year. Much of that growth occurred in G-7 credit default swaps and index products, in which trading volume tripled year-over-year. Trading volumes in interestrate derivatives also skyrocketed among Asian institutions, more than doubling to $722 billion. “Investors were actively looking to lock in hedges on the back of other investments,” says Tim Sangston.

Flight to quality shakes up dealer rankings

Retrenchment in domestic Asian bond markets is having a significant impact on the fortunes of the major broker-dealers competing for the fixed-income trading business of Asian institutions. In short: Dealers that have invested heavily to build a presence in local currency bond markets are feeling some real pain.

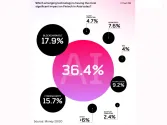

As part of its 2008 Asian Fixed-Income Investors Study, Greenwich asked nearly 770 institutional investors to name the dealers they use for their fixed-income trading business, to specify how much of their total trading business they allocate to each dealer in specific products and to rate the quality of service each dealer delivers. Based on the results of this research, Greenwich Associates compiles its Dealer Market Share Rankings, and identifies the Greenwich Quality Leaders for Asian Fixed-Income. HSBC rose to the top of Greenwich Associates’ Asian Fixed Income Dealer Rankings in 2007 to 2008 with a 12.1-percent market share in overall trading. Citigroup ranked second in this year’s rankings with 9.6-percent market share in Asian fixed-income trading, followed by Deutsche Bank at a 9.3- percent share.

“It is interesting to note that among all the major dealers competing in Asia, HSBC has built the biggest trading franchise in local-currency products,” says Tim Sangston. “But the banks’ strength in other areas and its market-leading scores for overall franchise quality over the course of the credit crisis have enabled it to weather the storm in Asia to this point.”

Asian domestic bond markets grew at a furious pace in the years leading up to the current global financial crisis. Trading volumes in the domestic currency bond markets of countries like China, Indonesia, Malaysia, India, Thailand and Australia/New Zealand increased more than 135 percent from 2006 to 2007 alone. As a result of this expansion, local currency products grew to make up over 50 percent of overall fixed-income trading volume across Asia in 2006 to 2007, up from just 30 percent the year before.

The onset of the global credit crisis stopped this growth in its tracks over the past year as local currency bond markets in many major Asian countries experienced severe retrenchment. Domestic currency fixed-income trading volume fell some 47 percent in India and contracted by about one third in China and Australia/New Zealand. These declines shrunk local-currency business to less than a third of total Asian fixed-income trading volume from 2007 to 2008.

“The development of these markets represented a profound shift for Asian financial markets,” says Greenwich Associates consultant Tim Sangston. “In the past, large Asian companies that earned most of their revenues in local currency had to obtain most of their long-term financing in dollars or European currencies—which history has proven is a dangerous position to be in. The emergence of thriving local-currency debt markets has been seen as an important new source of stability, but the severity of the current financial crisis leaves the near-term fate of these markets in real doubt.”

Surge in G-7 bonds boosts total trading volume

Despite the contraction in domestic markets—or perhaps because of it to some extent— overall Asian fixed-income trading volume (including derivatives) among investors interviewed by Greenwich Associates increased 35 percent to $2.3 trillion in 2007 to 2008. Trading volume in cash bonds was up 15 percent.

Much of that growth came about as a result of a surge of activity among institutions in Asian bonds denominated in the currencies of G-3 and G-7 countries, in which trading volumes doubled from 2007 to 2008. “This is a classic flight to quality on an historic scale,” says Tim Sangston. “Institutions are shifting en masse from local-currency bonds to Asian credit products denominated in G-3 and G-7 currencies.”

Asian institutional trading volumes in G-3 denominated Asian bonds soared 90 percent to $214 billion in 2007 to 2008. Fueling that growth was a dramatic spike in activity in G-3 denominated investment-grade sovereign/corporate issues, in which trading volume increased nearly four-fold, and in G-3 high-yield bonds, in which trading volumes more than tripled.

Overall trading volume in investment-grade credit products issued by companies in G-7 countries increased to $163 billion amongst Asian institutions in 2007 to 2008, up 55 percent from the prior year. Much of that growth occurred in G-7 credit default swaps and index products, in which trading volume tripled year-over-year. Trading volumes in interestrate derivatives also skyrocketed among Asian institutions, more than doubling to $722 billion. “Investors were actively looking to lock in hedges on the back of other investments,” says Tim Sangston.

Flight to quality shakes up dealer rankings

Retrenchment in domestic Asian bond markets is having a significant impact on the fortunes of the major broker-dealers competing for the fixed-income trading business of Asian institutions. In short: Dealers that have invested heavily to build a presence in local currency bond markets are feeling some real pain.

As part of its 2008 Asian Fixed-Income Investors Study, Greenwich asked nearly 770 institutional investors to name the dealers they use for their fixed-income trading business, to specify how much of their total trading business they allocate to each dealer in specific products and to rate the quality of service each dealer delivers. Based on the results of this research, Greenwich Associates compiles its Dealer Market Share Rankings, and identifies the Greenwich Quality Leaders for Asian Fixed-Income. HSBC rose to the top of Greenwich Associates’ Asian Fixed Income Dealer Rankings in 2007 to 2008 with a 12.1-percent market share in overall trading. Citigroup ranked second in this year’s rankings with 9.6-percent market share in Asian fixed-income trading, followed by Deutsche Bank at a 9.3- percent share.

“It is interesting to note that among all the major dealers competing in Asia, HSBC has built the biggest trading franchise in local-currency products,” says Tim Sangston. “But the banks’ strength in other areas and its market-leading scores for overall franchise quality over the course of the credit crisis have enabled it to weather the storm in Asia to this point.”