Asia Pacific is home to 28 percent of the world's HNWIs

The combined wealth of Asia Pacific's millionaires expanded 12.5 percent to U.S. $9.5 trillion last year, according to the third annual Asia Pacific Wealth Report published by Merrill Lynch and Capgemini. The report covered nine key markets in Asia Pacific: Australia, China, Hong Kong, India, Indonesia, Japan, Singapore, South Korea and Taiwan.

The number of the region's high net-worth-individuals (HNWIs) — individuals with more than U.S. $1 million in net assets, excluding their primary residence and consumables — increased 8.7 percent to 2.8 million, making Asia Pacific home to 27.8 percent of the world's HNWI population.

There were an estimated 172,000 HNWIs in Australia at the end of 2007, up 7.1 percent from a year earlier, with a combined wealth of U.S. $550 billion.

The increase in Australia's HNWI population was driven by economic growth, partly fueled by commodity exports to meet demand in Asian markets. The average net worth of Australia's HNWIs rose slightly to U.S. $3.2 million, compared with U.S. $3.4 million for the Asia Pacific region.

“Despite dislocations in developed markets, the number of high net worth individuals in Australia grew at a faster rate than the global average,” said Thomas Alexy, market director and head of Global Wealth Advisory for Merrill Lynch Australia. “Domestic demand and Asia's appetite for commodities continue to drive wealth accumulation in Australia.”

India, China Lead the Way

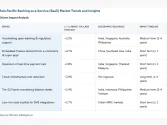

For the third straight year, Asia Pacific dominated the list of the world's ten fastest-growing markets for HNWIs, taking five of the top spots. India led the way with 22.7 percent increase in its HNWI population, followed by China at 20.3 percent South Korea, Indonesia and Singapore posted gains of 18.9 percent, 16.8 percent and 15.3 percent, respectively.

“Emerging markets are benefiting from recent reforms to the financial services industry and increases in foreign direct investment from international markets, such as the US, UK and Middle East,” said Wayne Li, senior manager, Capgemini's Financial Services strategic business unit. “As long as the region remains an engine of wealth creation, local and foreign investors will continue to pursue investment opportunities in the region.”

The number of Ultra-HNWIs in Asia Pacific jumped 16.4 percent to 20,400 last year, nearly double the 8.8 percent global growth rate. Ultra-HNWIs, or individuals with more than U.S. $30 million in financial assets, accounted for 26.3 percent of the region's combined HNWI wealth.

The Asia Pacific region also saw an increase in emerging-HNWIs, or individuals with between U.S. $750,000 and U.S. $1 million in investable assets. The number of emerging-HNWIs in Asia Pacific rose 6.9 percent last year, versus the global rate of 5.2 percent. In particular, China's emerging affluent class grew at 19.8 percent.

“The report paints a consistent picture of growth for the Asia Pacific region,” said Antony Hung, head of Pacific Rim Wealth Management at Merrill Lynch. “Strong domestic demand and a growing entrepreneurial class continue to spur wealth creation in this part of the world, presenting tremendous opportunities for wealth management providers.”

Drivers of Wealth

Economic growth and stock market returns were the key drivers of wealth accumulation in the Asia Pacific region last year.

Two-thirds of the markets covered in the report expanded their economies at a faster rate than the global average, with China and India reporting 11.4 percent and 7.9 percent real GDP growth, respectively. Despite deteriorating global economic conditions in the second half of 2007, robust domestic demand buoyed growth in most Asia Pacific economies.

As investors shifted funds away from troubled mature markets in favor of their stronger, emerging counterparts, Asia Pacific markets welcomed increased investment activity in the second half and enjoyed impressive gains. In addition, savings rates, as a percentage of GDP, were higher in Asia Pacific than most developed markets.

Asset Allocations Vary by Market

Market uncertainties in the second half of 2007 prompted Asia Pacific HNWIs to shift their assets to safer, less volatile asset classes. Last year, the region's wealthy allocated 46 percent of their holdings to cash/deposits and fixed-income securities, an increase of seven percentage points from 2006.

Asia Pacific HNWIs cut their exposure to real estate but the asset class remained a significant source of wealth for high-net-worth investors in the region. They held 20 percent of their assets in real estate last year, compared with the 14 percent global average.

Within the region, asset allocations differed from market to market. Australian HNWIs, for example, held 38 percent of their assets in equities, the highest in the region. Investors in India, Hong Kong and Singapore also had relatively high equity allocations.

South Korea's HNWIs continued to allocate the highest percentage of their holdings to real estate, putting 40 percent of their investments in the asset class. Unlike other investors in the region, Australian HNWIs increased their real estate allocations by one percentage point last year, driven by gains in the local property market.

Opportunities at Opposite Ends of the Wealth Spectrum

Competition for high-net-worth clients has prompted wealth management providers to look more closely at emerging-HNWIs and Ultra-HNWIs. In 2007, these groups experienced significant growth both in terms of numbers and their combined wealth. In India, emerging-HNWI wealth increased by 20.7 percent to U.S. $35 billion, and the assets of Ultra-HNWIs broke through the U.S. $100 billion barrier for the first time.

“Both local and foreign providers in the region recognize the potential of emerging-HNWIs and Ultra-HNWIs and are looking for ways to improve their priority and private banking models to better serve these segments” said Capgemini's Li. “Providers are also cognizant they must maintain a differentiated value proposition across the segments so as not to dilute their offerings to higher wealth tiers.”

Looking Ahead

While growth prospects in the near term may be compromised by the global slowdown, the long-term potential of the Asia Pacific HNWI marketplace remains strong. The region's HNWI wealth is projected to reach U.S. $13.9 trillion by 2012, growing at an annual pace of 7.9 percent and slightly ahead of the 7.7 percent global rate. By 2012, Asia Pacific is expected to replace Europe as the second-largest regional repository of HNWI wealth.

In 2009, Asia Pacific HNWIs are likely to turn to fixed-income securities that offer less volatile returns. They are also expected to increase their allocations to alternative investments, mainly in the form of hedge funds or other investments, more suited to uncertain market conditions.