China approves first exchange-traded bond funds

China will boosts its debt market by introducing low-cost, liquid products to a wider pool of investors.

The country hopes to accomplish this by launching its first exchange-traded bond funds.

Guotai Asset Management Co., which is partly owned by Italian insurer Assicurazioni Generali SpA, and Shenzhen-based Bosera Funds have received regulatory approval to launch exchange-traded funds (ETFs) for bonds, the China Securities Regulatory Commission said late on Tuesday.

Guotai will launch an ETF tracking an index of five-year treasuries, while Bosera will launch an ETF tracking an index of corporate bonds.

The government has said that bond futures and other derivatives will also be rolled out soon to offer vehicles for hedging, without giving a specific timetable.

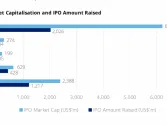

China has been encouraging companies to issue bonds to wean the economy from its reliance on bank lending and to alleviate pressure on its equities markets, where more than 800 companies are waiting to get listed.

Easier retail investor access to bond products would also give middle-class Chinese savers more opportunities to diversify their investment portfolios.

For more.